Inflation rates are rising to new record levels. In response, central banks are raising key interest rates. Especially on the

U.S. market in particular, the FED is raising interest rates at a rapid pace.

Supply chains are interrupted by the strict COVID policy of China and the war in Ukraine.

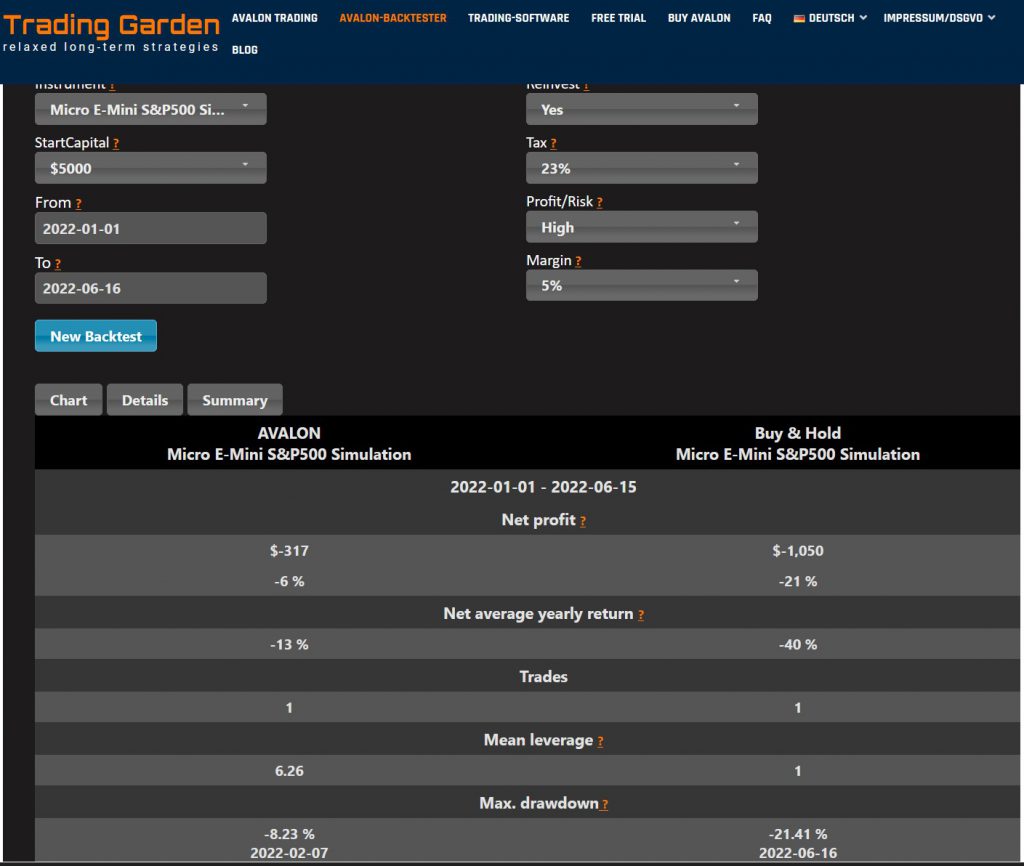

The reaction of the markets is accordingly. Since the beginning of the year, the S&P500 has lost 21% of its value.

For the first time, many investors, especially young ones, do not experience permanently rising prices and lose money.

How is the AVALON strategy doing in this period? Much better than the market. With a minus

AVALON is 15% better than the S&P500 with a minus of only 6%. There was only one minus trade from 19.01. to 07.02..

Since then AVALON is flat. Of course we are all looking forward to better times on the markets and when it is easier to realize profits.

Until then Happy Tading!

Frank Gärtner

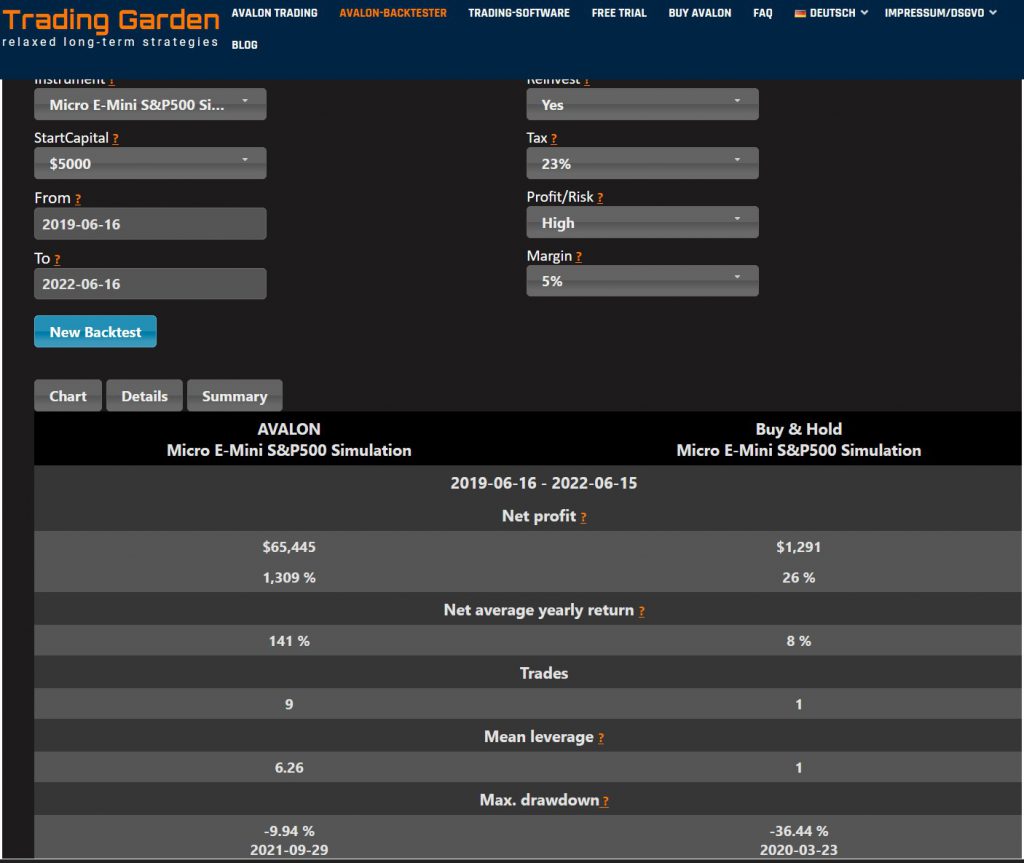

Ultimately, a consideration of individual years is not meaningful for a long-term strategy such as AVALON.

Looking at the last 3 years, AVALON shows a net gain of 279% (without reinvest) and 1,309% (with reinvest).

The S&P5000 gained 26%.